Construction: Succeeding Despite Timing and Compliance Issues

Amidst continued optimism in the industry, contract managers face delays, expenses and uncertainties as they manage performance in the COVID-19 world.

Funding for Infrastructure Projects Extended

The passage of a federal government stopgap measure has removed some uncertainty from the mix, curtailing unnecessary disruption of related public projects. Although a broad coalition of industries and policymakers would have preferred a long-term, well-funded extension of 2015s FAST Act, their pragmatic focus on the one-year extension was critical. As reported by Engineering News-Record (ENR): the stopgap measure:

Averts a looming shutdown of many federal agencies and—in a particular win for infrastructure advocates—also extends federal highway and transit programs for a full fiscal year.

Final congressional approval of the continuing resolution, or CR, came in the evening of Sept. 30, when the Senate passed it on a 84-10 vote.

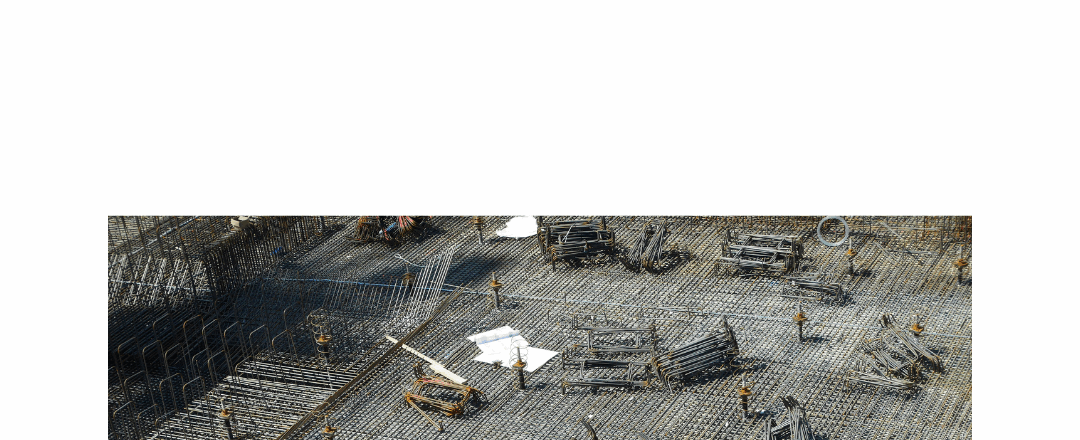

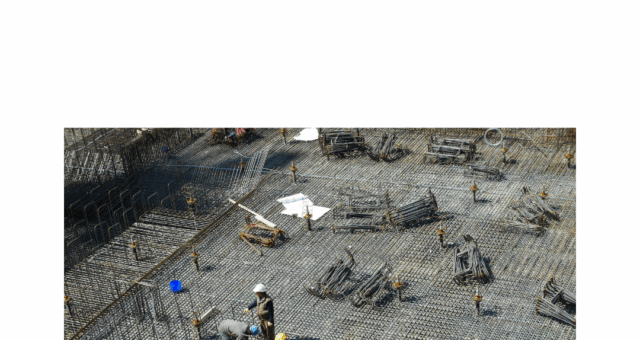

Managing New Variables In Construction Performance

Although there is general optimism that the construction industry will succeed despite the pandemic, managers have been dealing with challenges familiar to many industries in the COVID-19 era: delays, increased expenses, shutdowns and new risk and compliance issues.

As the Insurance Journal’s My New Markets report sums up:

Construction clients have been making adjustments, but the new safety protocols have added cost and new exposures, according to Danette Beck, national construction practice leader at Valhalla, N.Y.-based USI Insurance Services.

“No one had a plan for this,” she said, adding that some construction projects had 24 hours to get everyone off a construction project site. “How do you close the project down safely? How do assess employees? The call to action was pretty immediate.”

Contractors with project sites in multiple states faced various compliances rules at the same time, she said. Contractors are resilient and always have been, Beck noted. They staggered workforces. They took temperatures on sites. They shut down projects and created plans to get back up and running when possible.

Bid and Performance Bonds: Take Control of The Timing

Even in normal times, managing all the variables of construction projects is not for the faint-hearted! Now, with ever more dynamics to consider, contractors must control standard business practices even more efficiently.

Securing bid, performance and payment bonds in a timely manner is crucial to success in construction. Managed expediently, obtaining them can even catapult contractors to the front of the line in pursuit of new projects.

Colonial Surety Company uniquely sets you up for success with bid, performance, and payment bonds, by providing:

- Total Control

- Complete Transparency

- Greater Security

At Colonial Surety, once you have been approved for a Partnership Account® we give you our power of attorney and our corporate seal, empowering you to instantly issue your own bid, performance and payment bonds—without involving an insurance agent or broker.

With a Colonial Surety Partnership Account® , you receive a Company Dashboard and personal Owner’s Dashboard®, giving you direct access to your available line of credit, and your underwriting profile. You will always know where you stand as you manage your projects—and grow your business. See how we set you up for success–and get started now!

Partner For Success and Security

In addition to helping you with planning, transparency and valuable insights, Colonial Surety Company offers you greater security as you bid for your projects.

Our online digital platform means you by-pass the local agencies handling competitors—and your information is secure and confidential.

Colonial Surety Company already has over 20 years of experience providing businesses with instantly available, direct, online products. Licensed in all 50 states and US territories, Colonial Surety Company is the easy choice to obtain your I-Bond® (instant, online surety bond).

Take control of your time! Obtain a Colonial Surety Partnership Account® online: Apply Here Today!