COVID’s Impact on Estate Planning?

Even after living through the pandemic, it’s estimated that over two thirds of Americans still have no estate plan, which ultimately leaves loved ones with hard things to do and decide. Even if our means are modest, it’s best to get organized with plans for our own care and assets: estate planning–it’s time. Either a will or trust can be the anchor.

From Awareness To Action: Set Aside The Time

Essentially, our “estate” comprises everything we own when we die: “This will include real estate, financial accounts, personal property, and business interests. Your estate also includes any debts or liabilities you owe. Proper inheritance planning allows you to manage and distribute your estate according to your wishes while minimizing taxes and expenses.” Good estate planning also involves making arrangements for our own care and decision making needs, should we experience a decline. Importantly, when minor children are in the picture, estate planning involves designating a guardian, which is typically done when a will is created.

Though recent years have heightened awareness about all these critical reasons for estate planning, CNBC reports that too many of us are still unable to actually get to it:

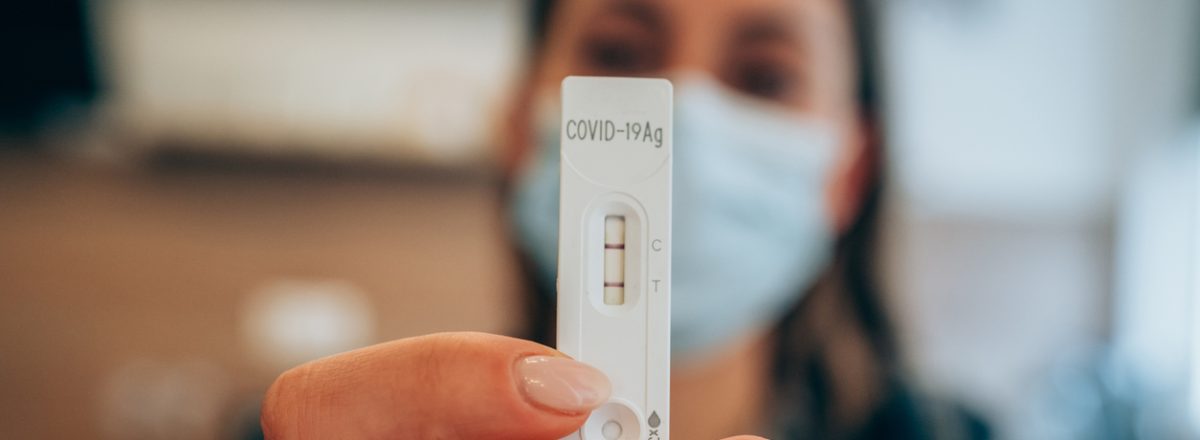

The Covid-19 pandemic has increased Americans’ awareness of the need to have a will, living trust or other similar end-of-life document prepared. Yet only about 33% of Americans have put these plans in place, according to a new survey from senior living referral service Caring.com. That means that 67% are leaving what happens to them and their assets in case of disability or death up to others….The biggest reason why: They just haven’t gotten around to it, according to 40% of survey respondents. Meanwhile, 33% said they don’t have enough assets to pass on to their loved ones, 13% said the estate-planning process is too costly and 12% said they do not know how to get a will. Notably, people who have had a serious case of Covid-19 are 66% more likely to engage in estate planning…. 41% of those ages 18 to 34 see greater need for …estate-planning…following…the pandemic.

Will or Trust?

For many of us, a basic last will and testament goes a long way toward leaving our affairs in order for loved ones. Assets left in wills must go through the public probate process, which may sound daunting, though the reality is that many states now offer expedited processes. If your documentation is in order and your executor prepared, a great deal of stress will be curtailed. However, once you have inventoried your assets and thought about to whom you want to distribute them—and how, as well as realized you may need a care plan for yourself as you age and potentially decline, you may find that a trust is best for your needs. Estate planning experts at Weinstein & Randisi offer this helpful snapshot of the essential differences between wills and trusts:

The person creating the will, known as the testator, can specify who will receive their property, money and personal belongings. A will also allows the testator to name a guardian for their minor children and an executor to carry out their wishes. A will goes into effect only after the testator’s death. The executor then takes the will to probate court, where a judge oversees the distribution of the estate. This process can take several months to complete and may involve court fees. However, a will is relatively easy to create and the testator can make changes at any time before their death.

A trust is a legal arrangement where a person, called the grantor, places assets into a trust for the benefit of others, known as beneficiaries. A trustee, who can be an individual or an institution, manages the trust according to the grantor’s instructions….

Trusts are flexible estate planning tools, in that when creating a trust, the grantor can specify how funds are to be distributed over time, or based on loved ones achieving certain milestones, like completing college or starting a business. Trusts can also be used to set aside funds for our own care, as well as for charities and even pets. Though trusts can be set up for many different purposes, there are essentially two types of trusts:

A revocable trust, also known as a living trust, allows the grantor to make changes or even dissolve the trust during their lifetime. This type of trust helps avoid probate, as assets transfer directly to the beneficiaries upon the grantor’s death. This can save time and money, and it provides more privacy since it avoids probate in which records are public.

Once the grantor has established an irrevocable trust, they cannot make changes or revoke the trust. This type of trust offers certain tax benefits and can protect assets from creditors, but it requires giving up control of the assets placed into the trust.

During estate planning, it’s wise to ask lawyers about the different types of trusts and carefully consider how a trust could address your specific goals. Ultimately, whether a will or trust is established, you will designate one or more fiduciaries to administer your plans. Depending on the specifics, location, and circumstances, a fiduciary may be specifically referred to as a trustee, executor or personal representative. Keep in mind that though it is traditional to appoint a relative, it is possible, and sometimes even preferable, to appoint a professional fiduciary.

Given their significant responsibilities, in most states, it’s typical for fiduciaries to obtain bonds to “guarantee that all the estate debts will be satisfied and that the remaining assets will be properly distributed to the appropriate heirs.” Information about all types of fiduciary bonds is available at Colonial Surety Company:

Estate Law?

With a few clicks on The Partnership Account® for Attorneys, lawyers can quickly help clients secure fiduciary and court bonds, on the specific obligee required forms for every state across the country.

Save time and stress with our online service, as you simply select the bond needed, send it to your client for payment, and then download, e-file or print the bond. Our fiduciary bonds include: administrator, estate, executor, guardian, personal representative, probate, surrogate, trustee, conservator and the list goes on. Court bonds include: appeal, supersedeas, injunction, replevin, receiver and more.

Easy, speedy court and fiduciary bonds every time, right here:

The Partnership Account® for Attorneys

Colonial Surety is rated “A Excellent” by A.M. Best Company, U.S. Treasury listed, and licensed for business everywhere in the USA. Our customers have awarded us a 4.8 Trustpilot score.